Join the ultimate

Learning Community

Join the ultimate Learning Community

HOME OF THE 8 DISCIPLINES OF ORIGINATION MASTERY

A Decades-Proven Formula for Loan Professionals

A Decades-Proven Formula for Loan Professionals

to Thrive Amid Market Changes

High-interest rates, fluctuating home prices, low inventory, and a growing preference for renting create a challenging landscape with no clear end in sight.

Acquiring new leads can be tough, and closing those sales is even tougher. You may be experiencing:

Lost trust

Frustrated clients and missed deals can erode trust and tarnish your professional reputation.

increased stress

Persistent challenges lead to heightened stress, affecting both your professional and personal life.

uncertain future

Inaction leads to an uncertain professional future, where the odds of thriving become slimmer.

declining business

Your client pool continues to shrink as potential buyers opt for renting over home buying. As a result, your loan origination business may experience a steady decline in revenue.

missed opportunities

High-interest rates and fluctuating home prices continue to affect your ability to close deals. Missed opportunities add up, affecting your income and professional growth.

stagnation

The intricacies of underwriting and stringent compliance regulations continue to hamper daily operations, leading to professional stagnation and unfulfilled potential.

You're seeking solutions for

Lost trust

Frustrated clients and missed deals can erode trust and tarnish your professional reputation.

Increased stress

The persistent challenges can lead to heightened stress levels, affecting both your professional and personal life.

uncertain future

Inaction can lead to an uncertain professional future, where the odds of thriving become slimmer.

DECLINING BUSINESS

Your client pool will continue to shrink as potential buyers opt for renting over home buying. As a result, your loan origination business might experience a steady decline in revenue.

Missed OPPORTUNITIES

High-interest rates and fluctuating home prices will continue to affect your ability to close deals. The missed opportunities will add up, affecting your income and professional growth.

Stagnation

The intricacies of underwriting and stringent compliance regulations will continue to hamper your daily operations. This may lead to professional stagnation and unfulfilled potential.

Introducing

the loan atlas

Exclusive New member offer

Gain access to exceptional mentors, experience tailored learning for your success, and pioneer a thriving community — all wrapped in unmatched value.

Gain access to exceptional mentors, experience tailored learning for your success,

and pioneer a thriving community — all wrapped in unmatched value.

2 payment options:

Premium Monthly

premium monthly

$349 Per Month

for 12 months

for 12 months

$349 Per Month

Premium Yearly

premium yearly

$3,490 Per year

pay in full - save $698

pay in full - save $1,000

$3,490 Per Year

Seven live, one-hour coaching calls every month.

An all-star faculty of coaches with over 29 billion dollars in collective loan funding.

Educational platform with over 200 trainings including Sales Scripting, Lead Flow Processes, Database Marketing, Building a Team and more.

The Perfect Loan Process™ - Streamline your entire loan process from initial inquiry to final approval

Marketing and presentation tools to help you generate more business.

BONUS: The Sales Conversion Accelerator:

Exact scripts you need to solve your sales conversion challenges.

THE LOAN ATLAS & MBS HIGHWAY

We have partnered with Barry Habib and team to fully SCHOLARSHIP your access to his $2,000 CMA Certified Mortgage Advisor program.

The CMA program was designed to educate and elevate the level of mortgage knowledge within the loan officer community. It encompasses 30 years of Barry Habib’s mortgage market and economics experience into a fast-paced and exciting designation for today’s loan Officers.

Our goal is that every loan officer we work with goes through the CMA program so they are fully equipped to deliver the most value to their families.

How to Be an Advisor to Combat Fintech

Understanding the markets

Understanding economic reports

The fed and recession indicators

Technical Analysis

Drive business through social media

HOW CMA AND THE LOAN ATLAS WORK TOGETHER TO HELP YOU:

CMA is a one-time infusion of knowledge that ensures you are an informed and certified mortgage advisor (with yearly renewal).

Barry Habib’s MBS Highway is a daily enforcement to make sure you stay educated on the market and equipped to add value to your customers.

The Loan Atlas membership helps you deploy your knowledge with real time scripts, presentations, and coaching that is working in today's market and to become the perfect conversion partner for Realtors.

If you are looking to become THE resource for your referral partners, customers and community, the combination of The Loan Atlas + CMA Certified Mortgage Advisor™ was made for you.

the loan atlas platform

AN INNOVATIVE AND INTUITIVE SOLUTION

Your gateway to expertise and conquering the loan industry. Access resources crafted by industry leaders, receive personalized guidance, and utilize invaluable tools to dominate the market.

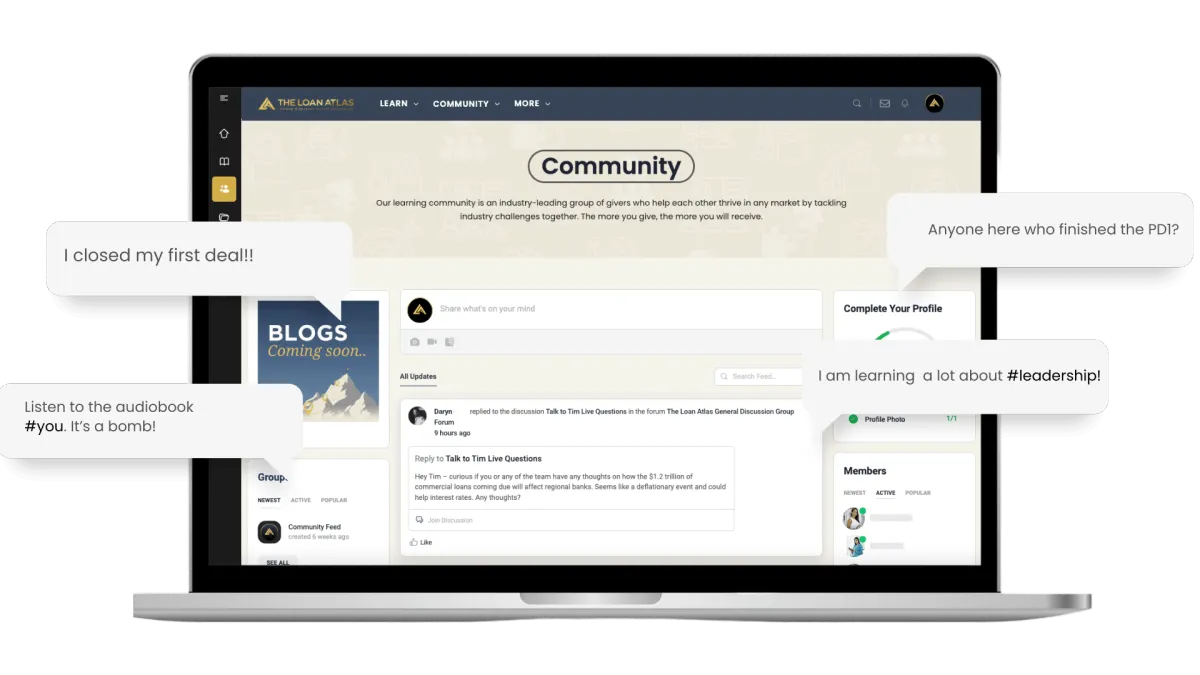

our community

WHERE SUCCESSFUL MORTGAGE PROFESSIONALS ARE MADE

Join our community where knowledge is shared, challenges are collaboratively addressed, and achievements are celebrated.

Connect with peers, engage in thought-provoking discussions, and cultivate enduring relationships. Expand your network and stay informed.

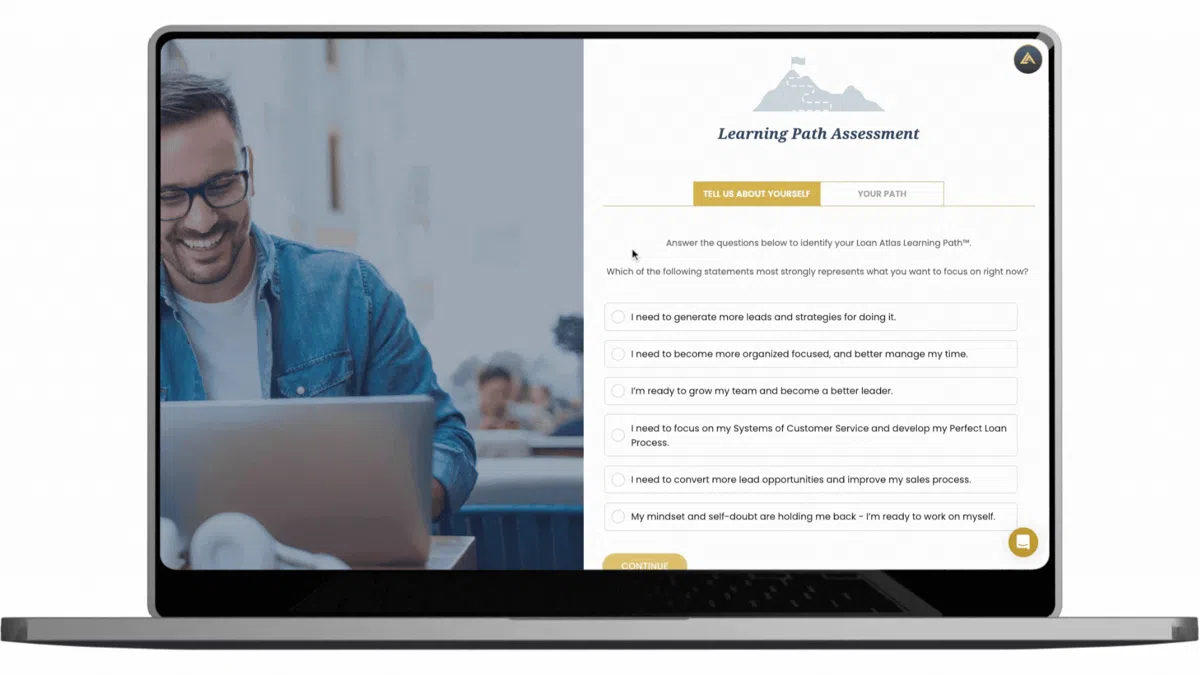

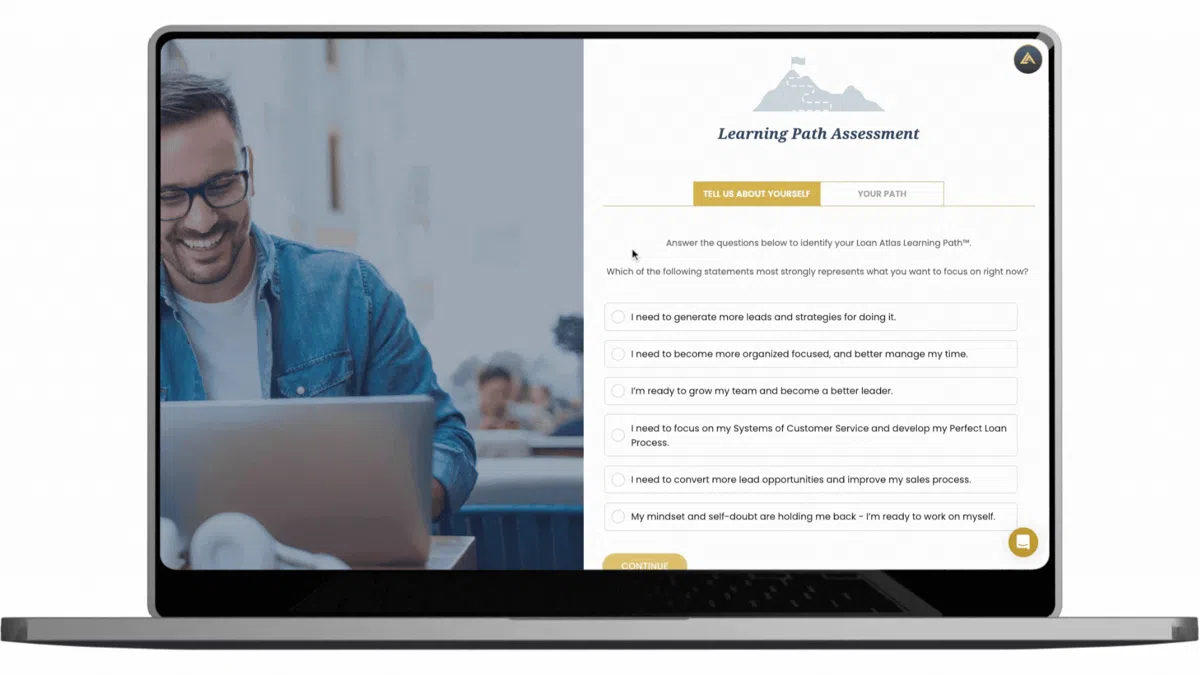

The learning pathway

Your Personalized trail to success

- on your terms.

Define your professional and personal fulfillment. The Loan Atlas Learning Path is an initial assessment to unlock your customized journey. Drawing from your response, we handpick modules and lessons to streamline your path without the overwhelm.

MEMBER ONLY Live Events

Collaborate and Grow with experts

MONTHLY INTERACTIVE MASTER CLASSES

Exclusive monthly interactive Master Classes. Dive deep into crucial topics and market strategies.

"TALK TO TIM LIVE"

Monthly Q&A sessions with our Chief Mentor, Tim Braheem — bring any questions to the table!

"COFFEE TALK"

Invigorating "Coffee Talk" roundtables with The Loan Atlas Faculty Mentors.

1-ON-1 COACHING

Optional 1:1 coaching with our Faculty Mentors (additional charges apply).

MONTHLY LIVE IMPLEMENTATION CALLS

Monthly live implementation calls ensure you're learning and actively implementing and progressing.

DIRECT "OFFICE HOURS" ACCESS

Direct office hours access to The Loan Atlas Faculty Mentors.

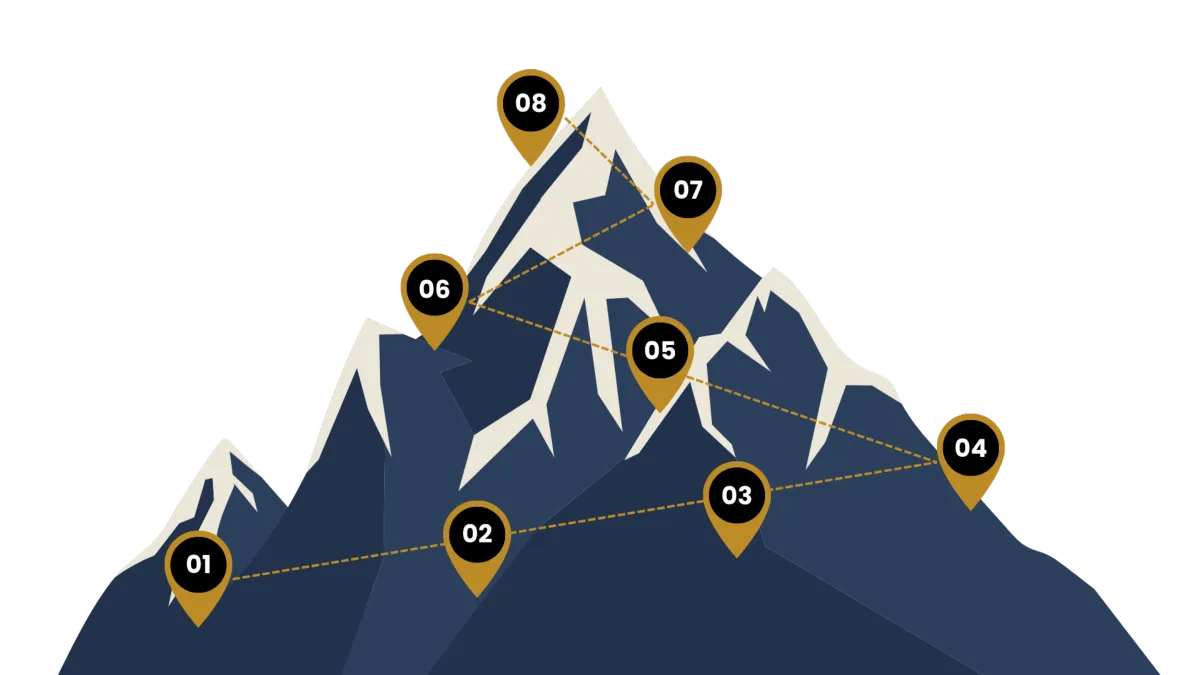

The 8 disciplines

YOUR NAVIGATION TO LOAN ORIGINATION MASTERY

The Loan Atlas presents an all-encompassing program for loan professionals to achieve a wide range of skills proficiency, personal fulfillment, and business excellence.

A LOOK INSIDE

the loan atlas

THE LEARNING MODULES

Video Lessons: Dive deep into The 8 Disciplines of loan origination mastery through engaging and comprehensive video sessions.

Transcripts: Prefer reading? We've got you covered with detailed transcripts for every Discipline.

Quizzes: Reinforce your learning and test your grasp on each lesson.

ESSENTIAL RESOURCES

Recorded Tips: Weekly voice broadcasts and video snippets from our Faculty to keep your momentum going.

Downloadables: Grab your learning documents, Success Scripts, support docs, worksheets, checklists, templates, and our inspirational white papers.

Audios: Relax with our meditative audios, contemplate with our thought-provoking tracks, and get access to exclusive presentations.

Marketing Vault: Propel your brand forward with top-tier marketing tools and insights.

Members-only Blogs: Be updated fast with industry insights, tips, and experiences shared exclusively for our community.

GAMIFIED COMMUNITY

Communication Tools: Engage in lively discussions, join groups, take up challenges, and connect directly with peers and mentors through forums and chats.

Gamification: Embark on an engaging journey with badges, points, and leaderboards by participating in our culture of support and collaboration.

Progress Check: Track your progress and share it with your peers for accountability.

Private Exclusive Podcast: The public gets a glimpse, but you'll access the full spectrum as a member.

PERKS & PRIVILEGES

Exclusive Discounts: Enjoy members-only discounts for our coaching programs and other platforms.

Mobile App (Coming Soon): Access The Loan Atlas on the go! A seamless learning experience right in your pocket.

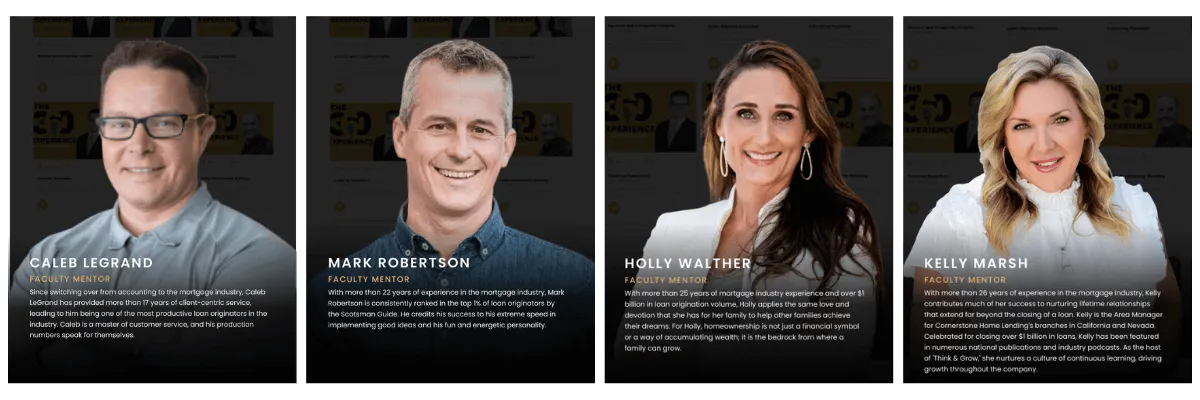

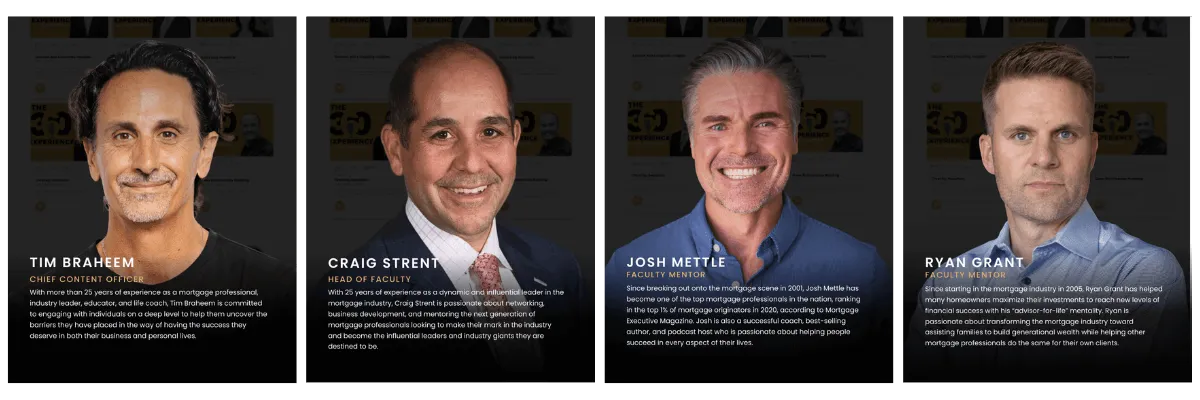

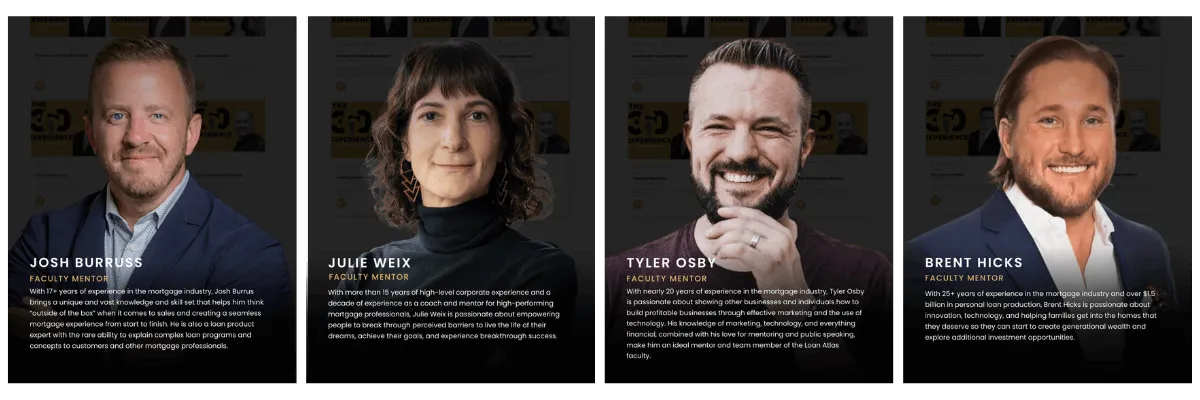

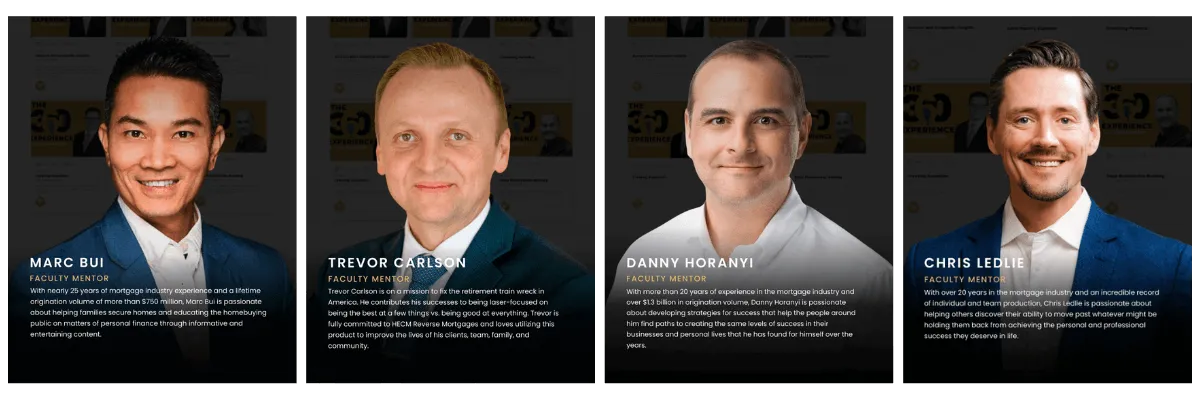

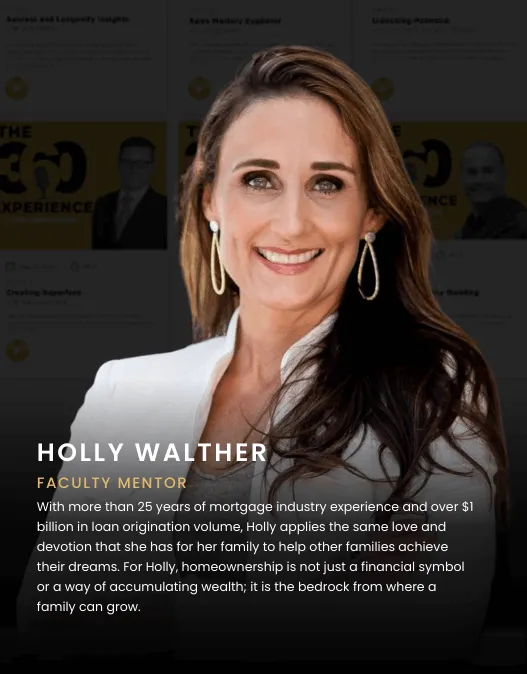

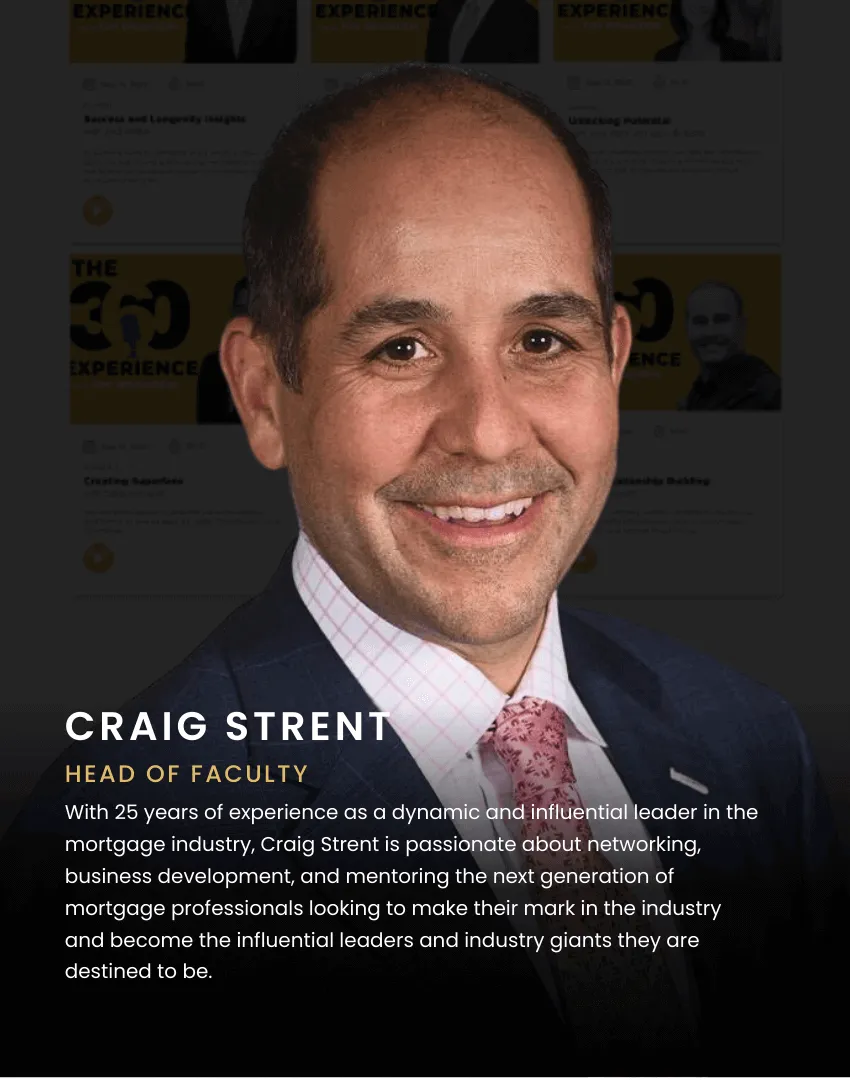

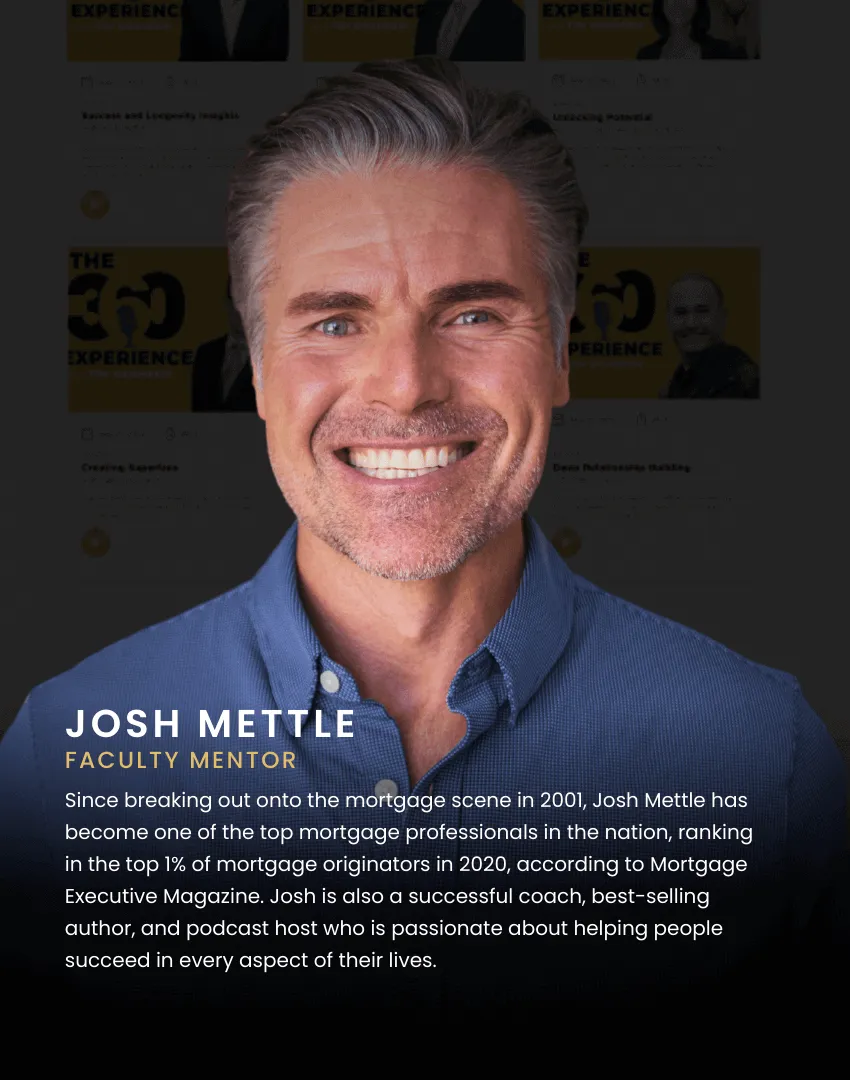

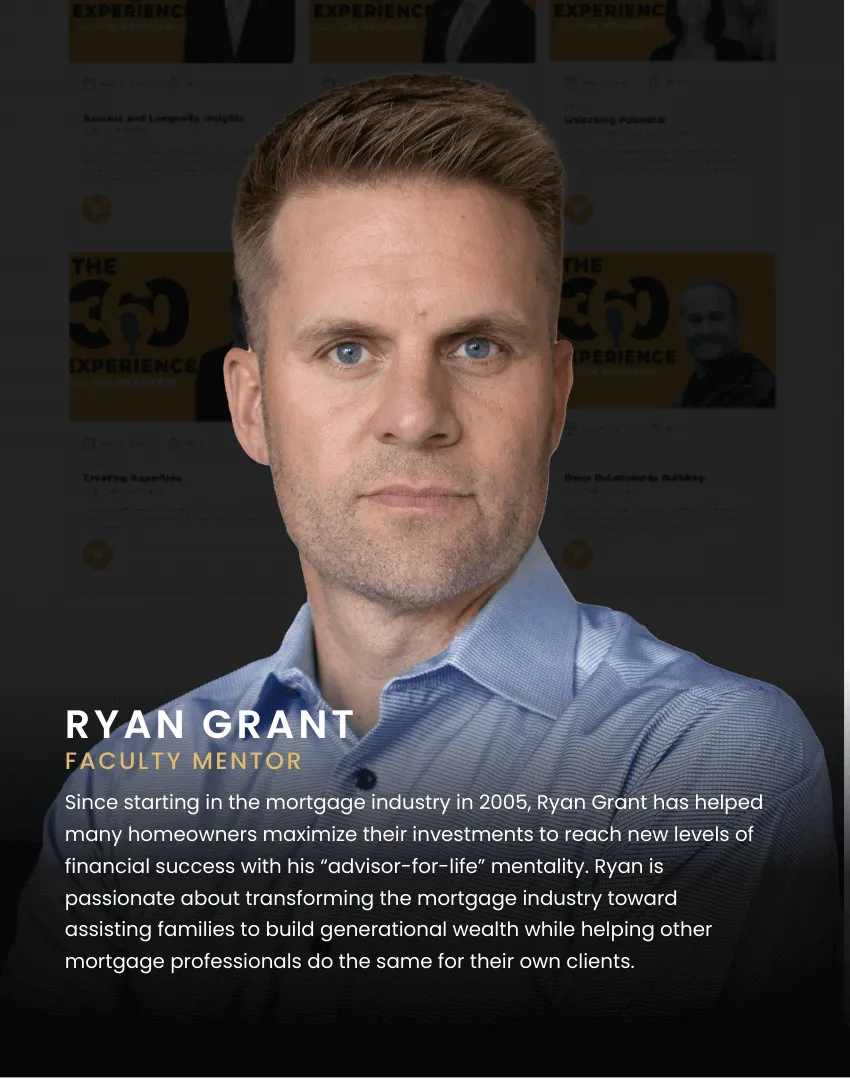

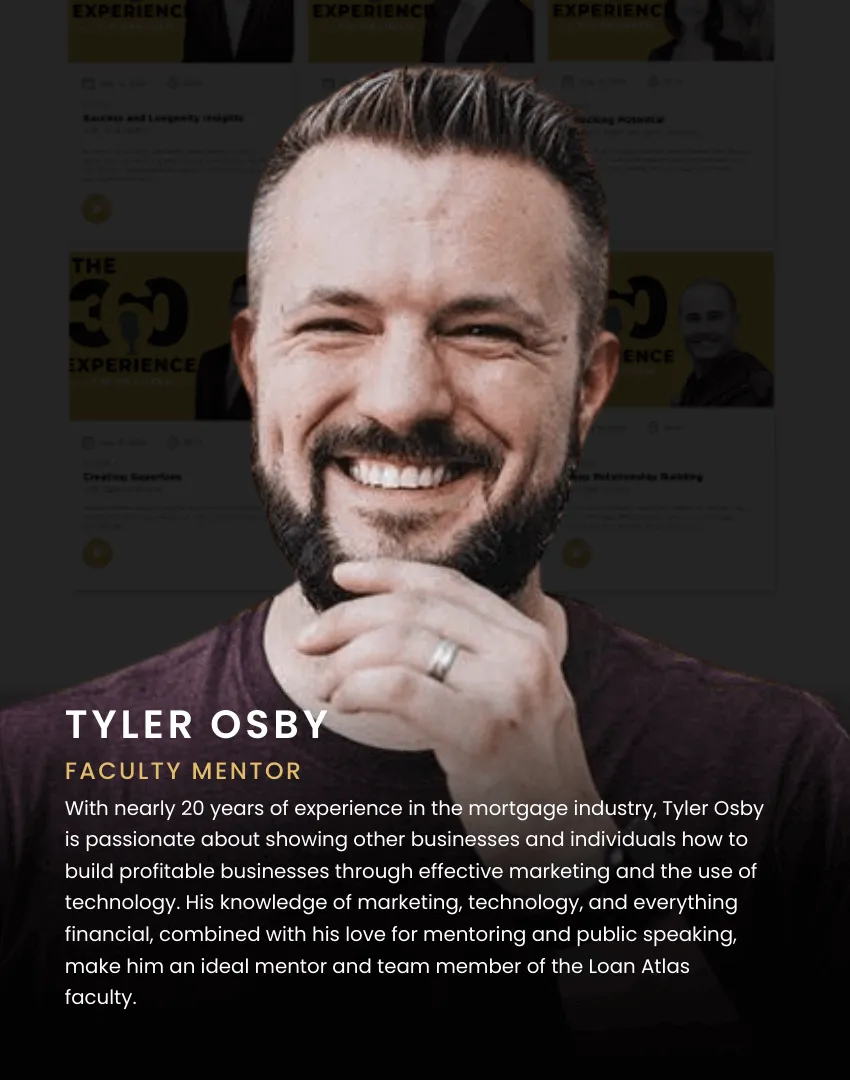

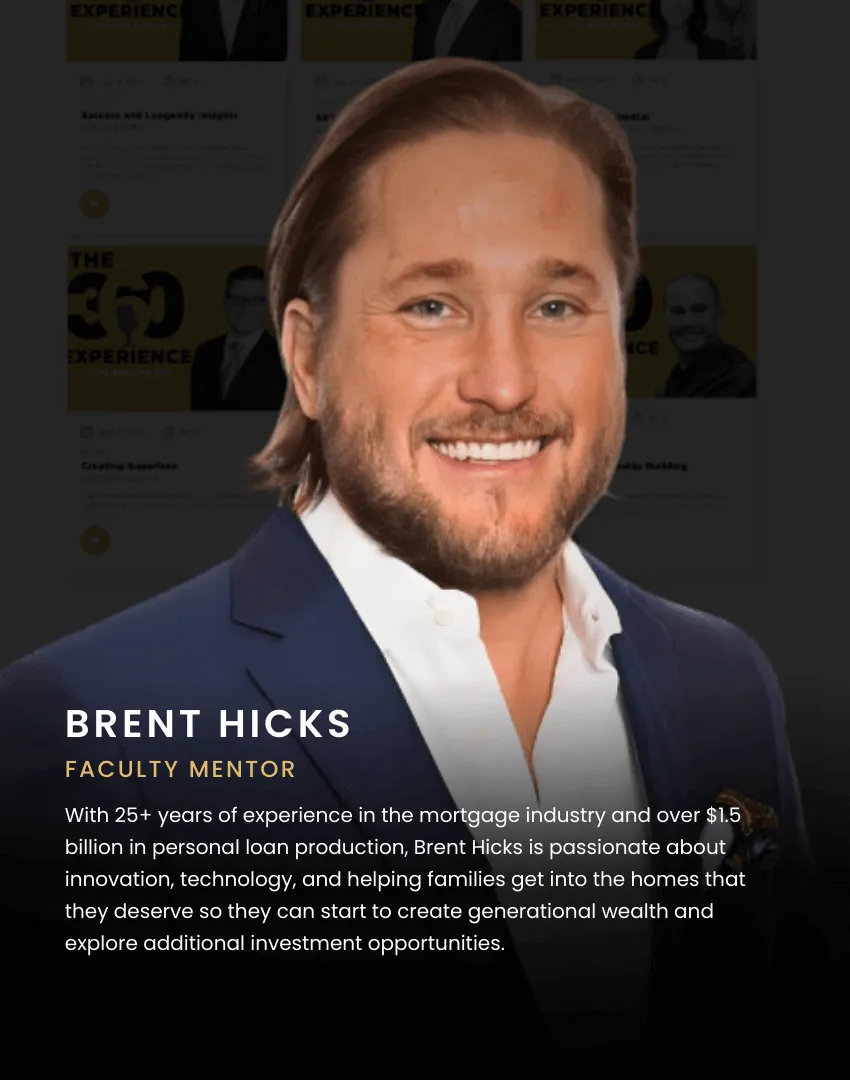

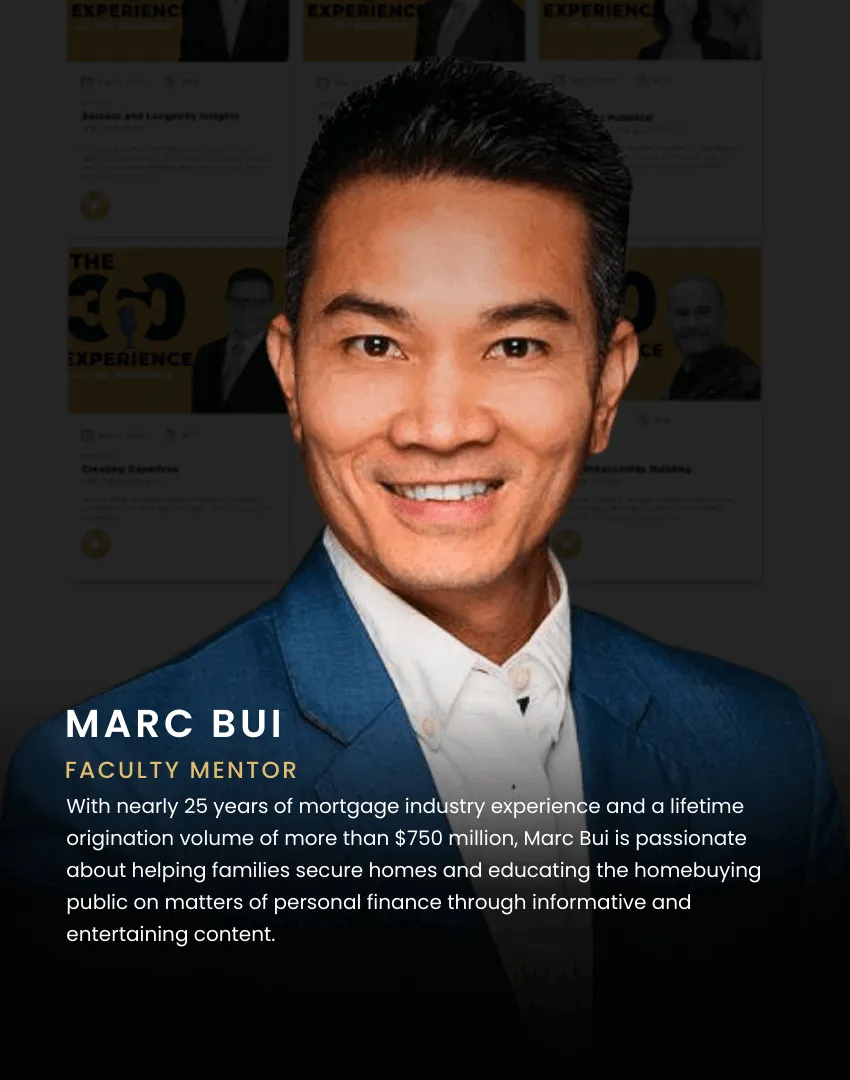

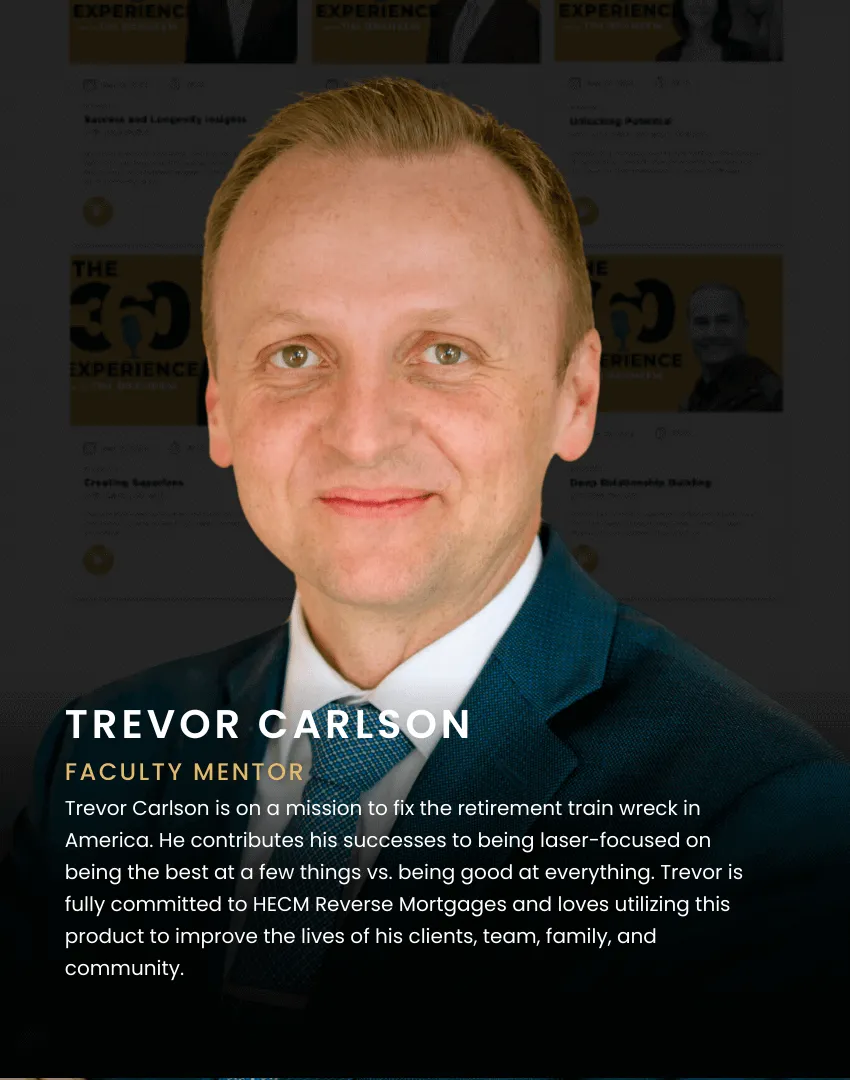

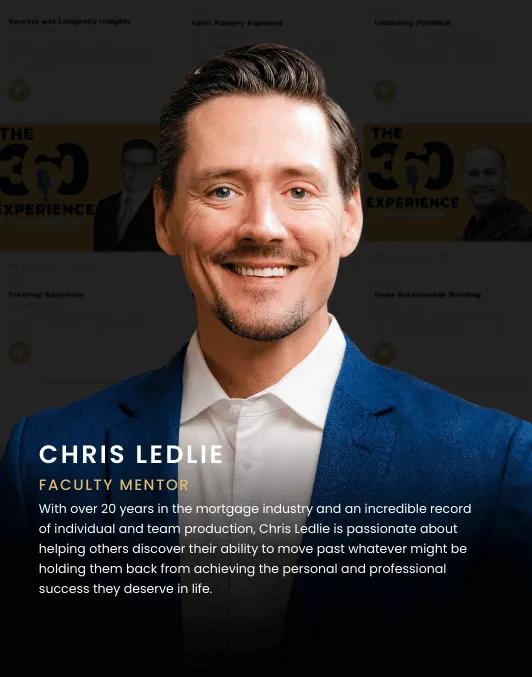

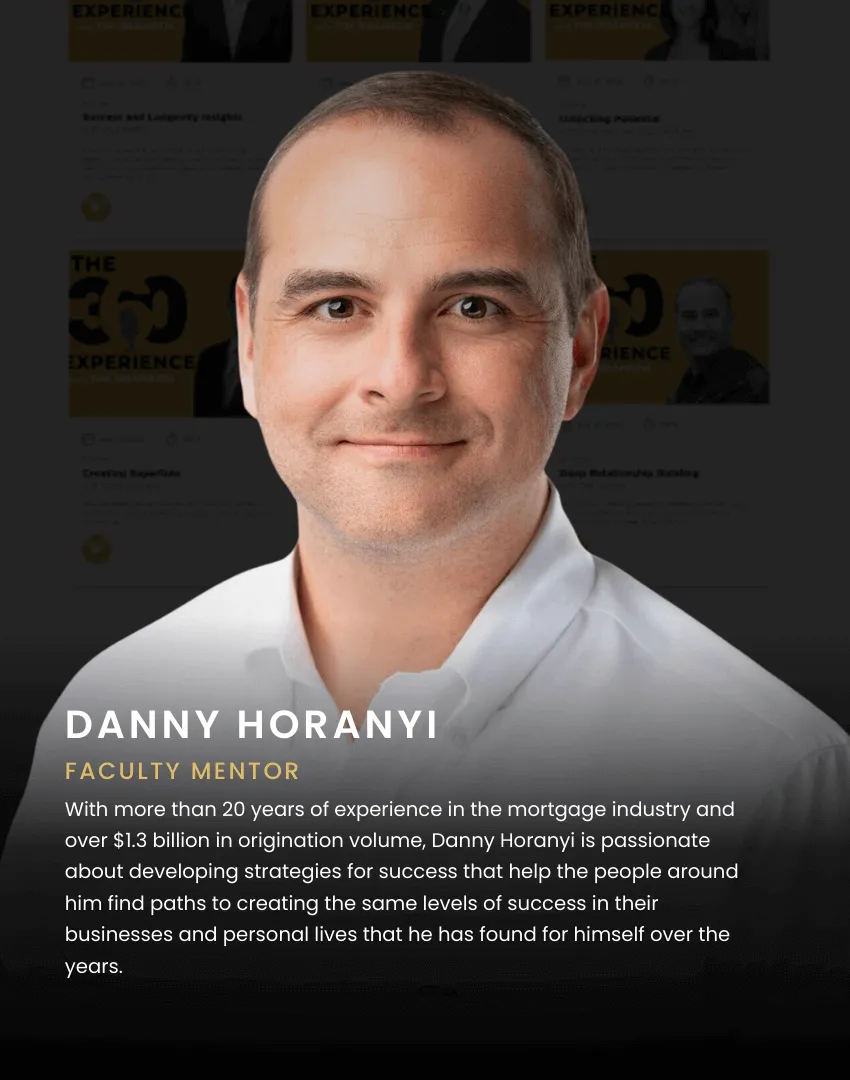

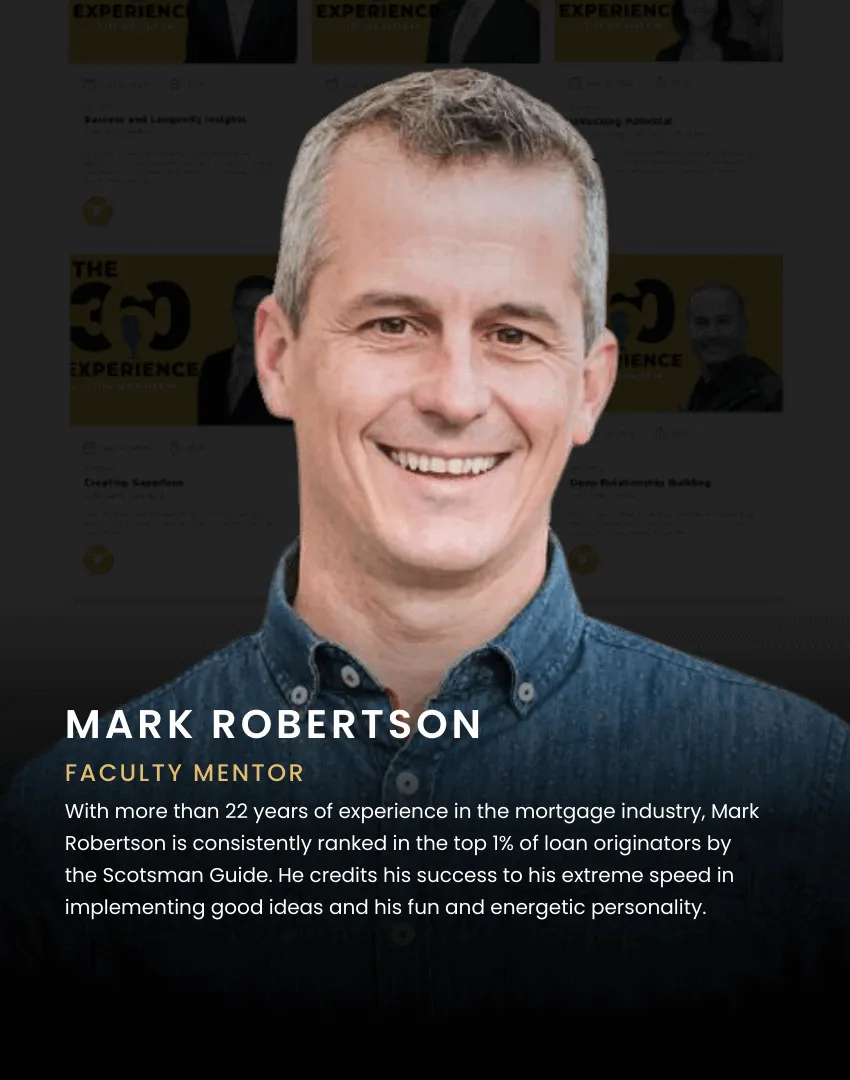

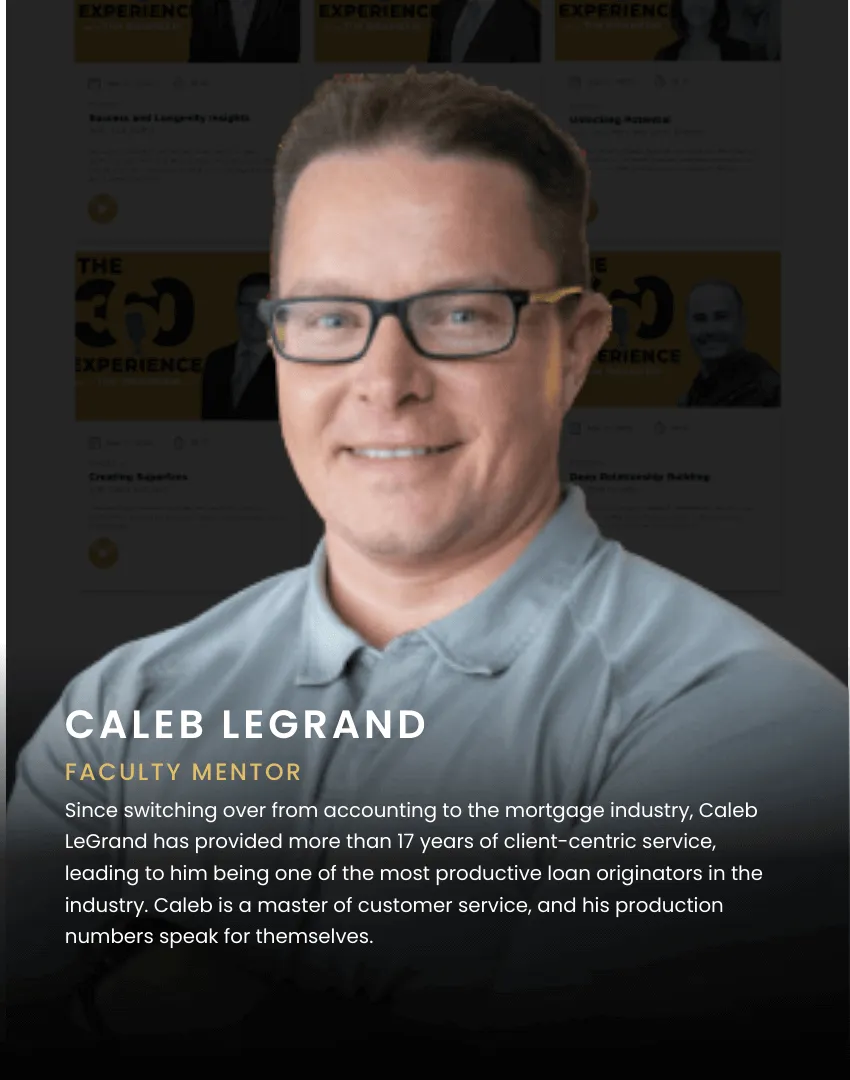

the loan atlas faculty

UNPRECEDENTED ALL-STAR TEAM OF HIGHLY REGARDED MENTORS

who have done over $29B in cumulative loan volume fully invested in your success.

We're committed to guiding you on a proven path to success with experienced, industry-legend mentors and a united community, driven by unwavering integrity.

Envision a loan industry where everyone thrives through genuine expertise, passion, innovative solutions, and a mantra of giving.

This is what we aspire to create — and it begins with you.

FREQUENTLY ASKED QUESTIONS

What distinguishes The Loan Atlas from other online courses or classes?

What sets The Loan Atlas apart is that we are dedicated to providing a pioneering and transformative learning experience that goes beyond traditional online courses or classes. Our most distinctive feature is our talented and giving faculty, a team of highly regarded mentors with a collective loan volume of $29 billion. These gifted teachers, including Tim Braheem, Craig Strent, Ryan Grant, Josh Mettle, and other distinguished experts, offer more than just knowledge; they provide a proven pathway to success in any market situation.

How do I get started with The Loan Atlas?

Getting started with The Loan Atlas is a straightforward process that offers more than just a learning journey. Once the day arrives, sign up and select your desired membership level. Then, as you embark on your tailored learning journey, you also get to join our vibrant community. It's not just about solitary learning; it's an opportunity to participate in conversations, collaborate with peers, and be a part of a supportive network dedicated to your success. So, join the community and dive into your personalized learning adventure with us.

How do I know if The Loan Atlas is the right platform for me?

With The Loan Atlas, you'll track not only your personal and professional growth but also cultivate better connections in your career, family, and personal relationships while maximizing business opportunities. It's a comprehensive and comprehensive approach to your growth, both as a professional and as an individual.

Can you clarify payments and membership commitments?

Of course! We have a straightforward payment structure. Membership in The Loan Atlas is an annual subscription that can be paid at once for a substantial discount or in monthly installments that are auto-billed.

What are the specifics of the money-back guarantee?

We stand by the value of The Loan Atlas experience. That's why we offer a 7-day, no-questions-asked money-back guarantee. If you feel The Loan Atlas isn't suitable for you within your first week, notify us through our platform’s chat feature, and we'll process a full refund ASAP.